ALBANY, Bahamas — When it comes to celebrity spotting, you could do a lot worse than Albany.

The Bahamas enclave — and host site of this week’s Hero World Challenge — is a regular playground for the rich and famous. Albany, self-described as “600-acre luxury resort community,” was founded in 2010 by Justin Timberlake, Tiger Woods, Ernie Els and billionaire businessman (and Tottenham owner) Joe Lewis. It’s nothing like real life, and perhaps that’s the point: it is almost exclusively an escape for A-listers. Albany is a place where David Beckham can run routes for Tom Brady on the beach or where Michael Strahan can house Jon Rahm during a pro-am rain delay. It’s also, as it turns out, a place where the crypto world’s most wanted man can lay low.

The eyes of the golf world have been trained on Albany this week because of Woods’ reappearance; he’d been out of the public eye since the Open Championship in July. At this point, Woods is used to being the most mysterious man on property. But not this week. Not with Sam Bankman-Fried, he of the fallen $16 billion crypto empire, staying right next door.

Where is SBF?

That’s the question that has been floating around property all week. New Providence is a small island and Albany is a small, uber-exclusive corner of that island. The Hero World Challenge brings the who’s-who of this little golfing community together. Many of the pros in the 20-player field are staying within the confines this week, either in their own places — like Woods — or in arranged rental units. While Bankman-Fried’s whereabouts haven’t been confirmed (and he has a number of properties to choose from), he and a group of co-workers had been living in a $40 million luxury penthouse in Albany’s Orchid building until very recently. As luck would have it, the Orchid is just a mid-iron from the golf course and a couple doors away from the pros in residence. In other words, everyone has had their eyes out.

What was Tiger Woods’ spiciest press conference take?By: Dylan Dethier , Sean Zak , James Colgan

Most Tour pros weren’t eager to talk about Bankman-Fried on the record, both because of the charged nature of the subject and their unfamiliarity with the specifics. But plenty were curious.

“Literally whatever you tell me, I will believe,” one pro said.

“I’ve been literally looking for him everywhere,” said another.

“My buddy told me to hurt him if I see him,” added a third.

One source staying at Albany described seeing Bankman-Fried walking barefoot around the property, glancing continually over his shoulder. A pro relayed a story he’d heard from a well-connected pro-am participant who had been wondering aloud where Bankman-Fried was just moments before he walked into the lobby of his luxury condo — only to find Bankman-Fried standing there, “nose-to-nose.”

Perhaps we’ve made it too far for introductions, but in case some explanation would help: Bankman-Fried is the 30-year-old founder of the cryptocurrency exchange FTX, which was the second-largest in the world until earlier this month. Things took a sudden turn on Nov. 8, when irregularities in a leaked FTX balance sheet triggered a “giant withdrawal surge” in which customers rushed to take out their money. Long story short, there wasn’t enough of it left to withdraw, and the subsequent solvency crisis sent the company tumbling into a high-profile bankruptcy. Bankman-Fried’s personal net worth didn’t fare well, either, making a record-setting drop from an estimated $10.5 billion to effectively zero in a matter of a few days.

So where does Albany come in? Last year, Bankman-Fried left Hong Kong and made the Bahamas FTX’s headquarters, citing its welcoming approach to crypto and relatively lax pandemic restrictions. That process included nearly $300 million in spending, both in nearby Nassau and within Albany’s confines, where he bought several units to be used by himself and fellow employees. An estimated 100 FTX employees relocated, including the group that lived with Bankman-Fried in his penthouse.

FTX had long since barged into the sports world. The Miami Heat played in FTX Arena. F1’s Mercedes team struck a sponsorship deal. In an appeal to the company’s apparent credibility, Major League Baseball had the FTX logo worn by its umpires. The list of athletes who’d endorsed the company was long and star-studded, with Tom Brady, Steph Curry, and Shaquille O’Neal among them. Its connections to the golf world were lower profile, but there was at least one endorsement: FTX signed a deal to be on the bag of LPGA pro Albane Valenzuela, whose family lives in the Bahamas.

We’re incredibly excited to announce 2x Olympian @AlbaneGolf as our first professional golf athlete ambassador! 🏌️♀️⛳️

— FTX (@FTX_Official) December 6, 2021

Welcome to the FTX fam, Albane!#FTXYouIn pic.twitter.com/wjqZLDC38V

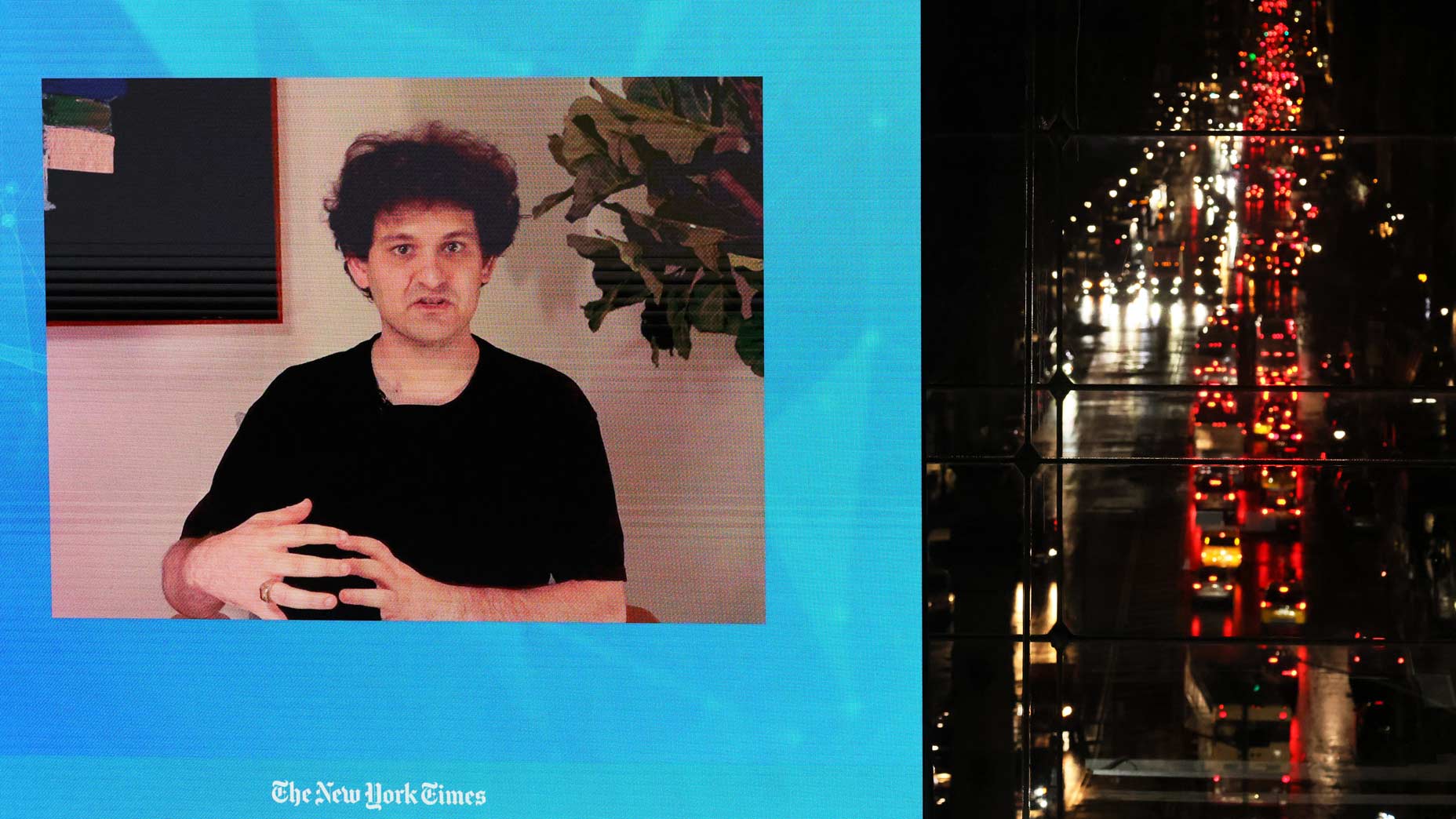

Until this week, Bankman-Fried had been laying low; other than a couple paparazzi-style shots and some phone videos, nobody had seen nor spoken with him. But on Wednesday the embattled CEO did an interview with the New York Times’ Andrew Ross Sorkin. He’s slated to appear on “Good Morning America” on Friday morning. Bankman-Fried is coming back on the grid.

In Wednesday’s interview, Bankman-Frid made it clear that FTX’s lost fortunes won’t be recovered. He also addressed his own finances, admitting he was down to one credit card and $100,000 in the bank.

“I don’t have any hidden funds here,” he said.

As to whether he could leave the Bahamas for the U.S.?

“To my knowledge, I could,” he said.

Until he does, curiosity will continue at Albany — all while the real-world implications of the FTX implosion unfold outside its gates.