In the beginning, there was the golf club, and it was pretty good—good enough, at least, for 15th-century Scottish shepherds swatting balls beside the sea. But then the gods of industry created better options, transforming crude equipment made from wood and leather into shiny implements of iron, brass and steel.

And golfers looked upon this and thought, Wow, cool.

Generations came and went, begetting more advances, and with them new design materials and marketing-speak, so that soon the eager player, gazing across a landscape filled with carbon fibers and adjustable clubheads, was left to ponder questions both exciting and confusing. Which shaft flex and kickpoint are best suited to my swing speed and path? How to tweak the loft and lie to get the most out of my driver, given my angle of attack?

Among savvy consumers and equipment-makers alike came the growing understanding that unless you had a handle on that and other data, shelling out for new sticks didn’t make a ton of sense.

In this dawning light, the modern clubfitting industry was born. Today that industry touches nearly every corner of the game, from big-box stores and pro shops to the practice range on the PGA Tour. It has changed how clubmakers manufacture, retailers sell, shoppers buy and golfers perform. Yet it still has ample room to spread its reach.

Market research shows that despite increased awareness of the benefits it brings, roughly one-third of avid golfers (defined as those who play eight or more rounds a year) have never been fitted for clubs. Across the general population of golfers, the percentage of clubfitting virgins grows.

That less skilled players are often less inclined to get fitted is ironic, since they tend to reap the most rewards. According to Mark Timms, founder of Scottsdale-based clubfitter CoolClubs, a 30-handicapper put through a fitting shaves an average of seven strokes from his score.

Timms got into the business nearly 30 years ago with a custom-club shop in Connecticut. Even back then, it mystified him why anyone would buy a golf club off the rack. Given the evolution of clubfitting since, to say nothing of the spread of consumer education, he’s baffled all the more that people still do so today.

“There’s just so much variance out there, even within the same model of club,” Timms says. “It’s why you can try your buddy’s driver and love it, and then you get the same one for yourself and you can’t hit it. Why would you buy a club like that? You wouldn’t buy a suit without trying it on.”

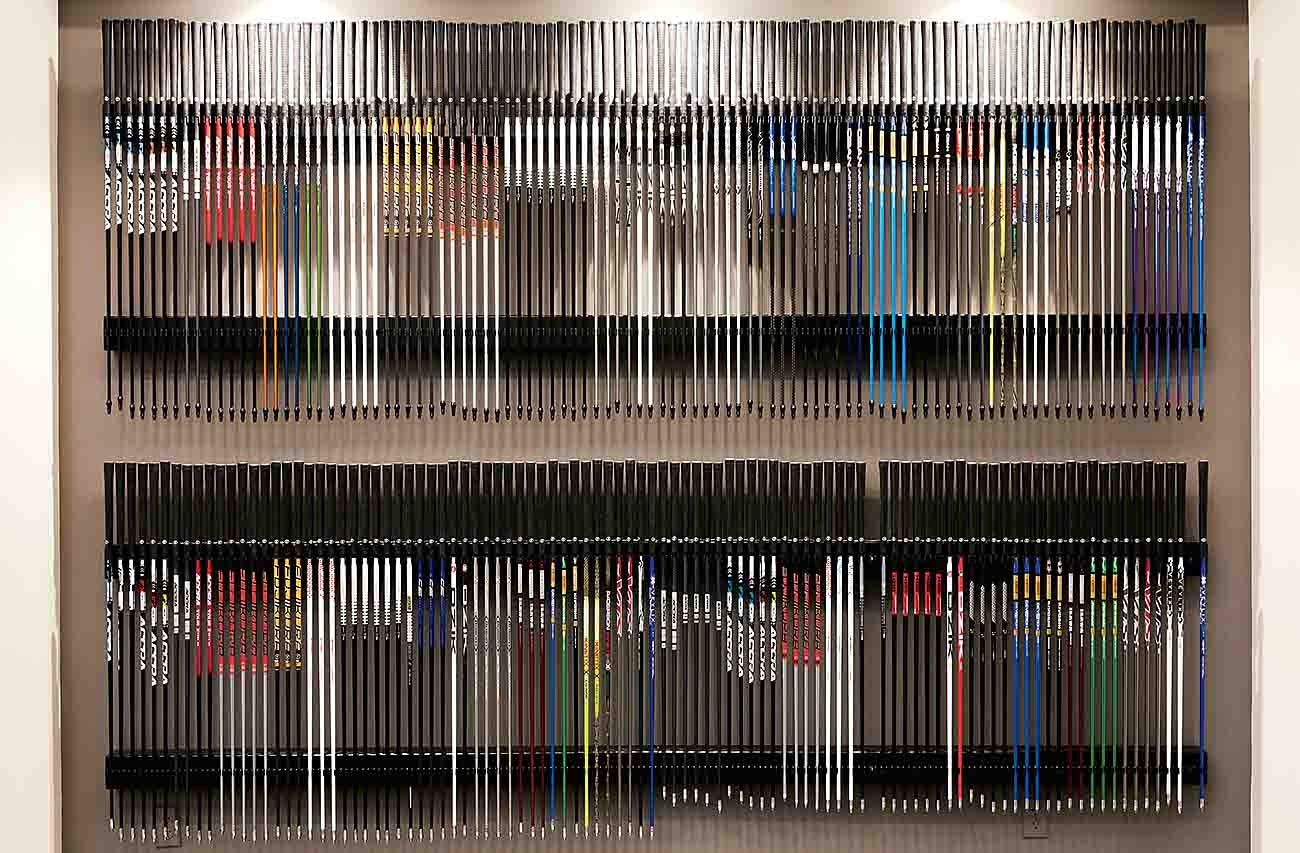

CoolClubs operates at the high-end of the clubfitting market, a boutique sector occupied by a handful of companies, including Hot Stix, Club Champion, GOLFTEC and True Spec Golf. (True Spec and GOLF are operated by the same holding company, 8AM Golf.) To set themselves apart from their competition, these operators emphasize such factors as the sophistication of their technology, the expertise of their fitters and the personalization of the experience. For example, at GOLFTEC, which has 200 locations around the world, many clubfitters are certified PGA teaching professionals, so studio sessions double as lessons. Fitness work is part of the process, too. One of True Spec’s calling cards is its brand-agnosticism. Name the manufacturer or the component; True Spec carries it but plays no favorites. Of the 30,000-plus possible combinations of shafts, clubs and grips, its staff will analyze the numbers, then custom-build the clubs that fit you best. Data is king.

This was not a service offered to King James IV of Scotland, who commissioned the first known set of custom clubs a little more than 500 years ago. Nor was it available in the 1950s to the famously fastidious Ben Hogan, who preferred to have his clubs set at atypical lofts, with their heels ground down so the face lay open, in hook-prevention mode. As recently as the 1990s, clubfitting remained a rarefied practice, out of sight and mind for the average Jane or Joe. Elite players used it, as did manufacturers for R&D. But even for Tour pros, what passed for clubfitting was often just a game of educated guesswork; they hit a lot of clubs until they found the ones they liked. In those days, a lot of clubfitting depended on tools—lie boards, stickers, slow-eyed cameras, dim-witted computers—that are now about as current as persimmon heads.

But as with so much else in golf, what started at the Tour level progressed at light-speed and filtered down. Among the first to notice was Karsten Solheim, who helped bring customization to the masses by placing colored dots on his clubs to indicate lie angle and shaft length, which now sounds almost quaint given the trail that technology has blazed. When today’s top fitters test a shaft, for instance, they don’t just measure flex or find the kickpoint. They gauge the load and torque at hundreds, if not thousands, of points between the hosel and the butt end. The other engines of their business are bleeding-edge launch monitors that track speeds, spin rates and flight paths with military-grade precision. The growing affordability of these machines, which have plunged in price to roughly $25,000 (down from $125,000 in the early 2000s), has further thrust high-end clubfitting into the public sphere by making it a viable business.

Launch monitors: They’re not just for test labs anymore.

Of course, all the major manufacturers have them, too. Customization is central to their business, not only in the fittings that they offer and encourage, but also in the equipment that they develop. The market demands it.

“Clubfitting has had an enormous impact on what we do,” says Josh Talge, vice president of marketing for Titleist clubs. “When you look at things like moveable weights and adjustable hosels, those are massive nods to fitting.”

Of Titleist’s direct iron sales today, some 75 percent arise from custom fitting. The more the better, as equipment-makers see it. It boosts the odds that folks who buy them will really dig their clubs.

This dynamic is part of a positive-feedback loop in which market forces drive consumer interest and the other way around. Golfers are increasingly interested in fitting, and the industry is ever-more prepared to provide it, not only at high-end studios but at a growing number of big-box stores and pro shops. As fewer golfers buy clubs off-the-rack, traditional retailers have scrambled to adapt.

As a clubfitter might say, some other telling trends show up in the data. A recent annual survey by New York–based Sports & Leisure Research Group found that golfers today are 48 percent more likely than they were in 2012 to believe that the right equipment can improve their game. With such bullishness comes a greater willingness to break out the wallet. In that same survey, projections point toward a 25 percent boost in per-capita equipment spending in 2019.

Clubfitting doesn’t get all the credit; its definitive impact is hard to quantity. But it has helped crystallize consumer convictions.

“That’s one of the benefits of a high-end fitting studio, like a True Spec or Club Champion,” says Sports & Leisure president Jon Last. “The majority of recreational golfers might not understand terms like kickpoint or moment of inertia, or the specific engineering of what makes equipment better, but a fitting can help them put a number on it. Their convictions are affirmed by what they see.”

True Spec and GOLF.com are operated by the same holding company, 8AM Golf.