LIV Golf has a TV problem, and evidently more solutions than it knows what to do with.

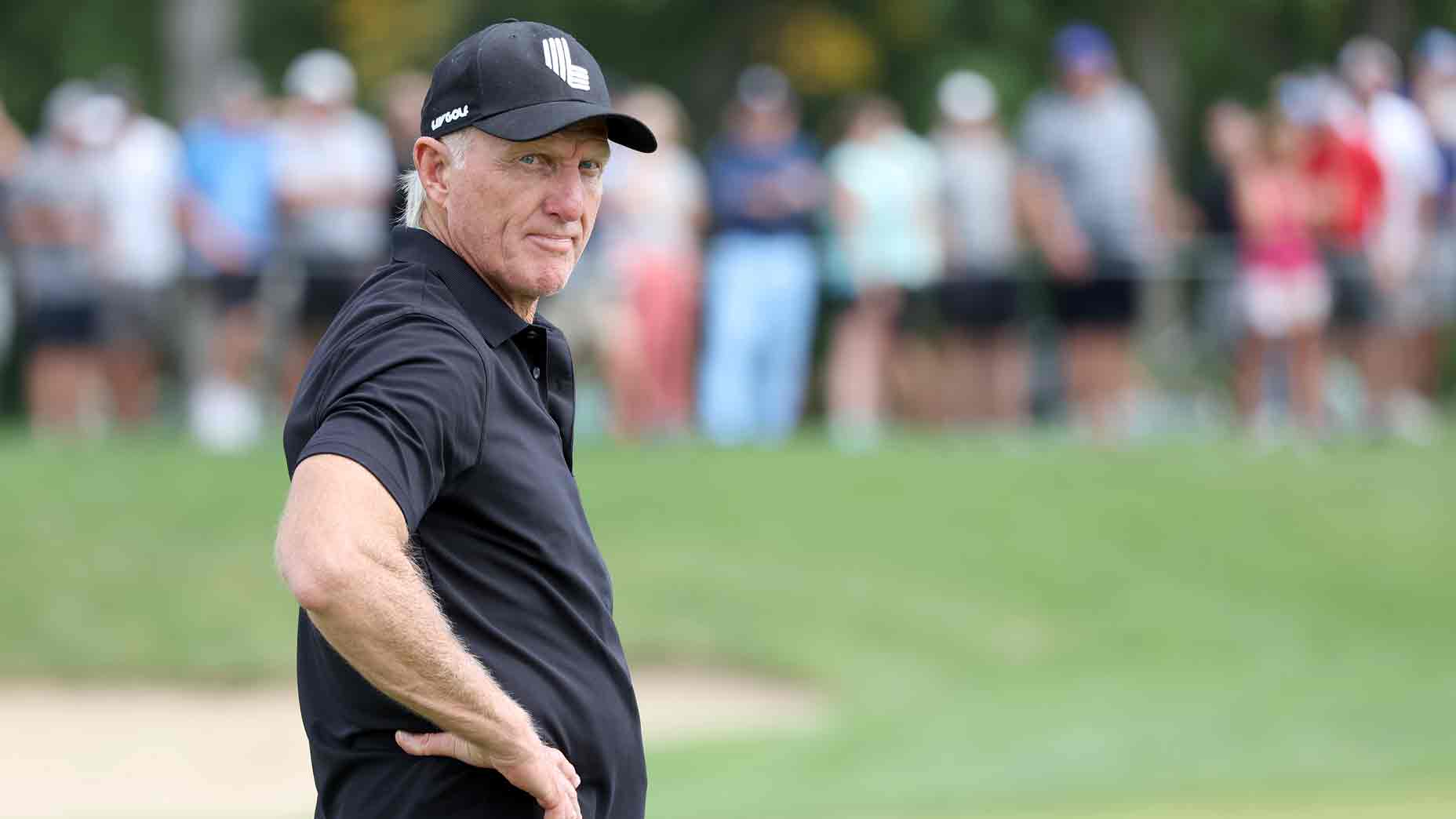

In an interview with ESPN 1000 Chicago on Wednesday ahead of the fourth LIV Golf Invitational Series event in Chicago, LIV commissioner and CEO Greg Norman said that conversations over the Saudi-backed league’s television rights have turned into something of a bidding war.

“Well, yeah, I can’t comment on that quite honestly,” Norman said. “All I can tell you is that the interest coming across our plate right now is enormous.”

To date, a television deal has proved elusive for the upstart league, which currently broadcasts its tournaments for free on YouTube. The league has reportedly been in discussions with networks dating back to at least early 2022, though it has yet to strike any kind of official broadcast agreement.

In an interview with @ESPN1000, Greg Norman says LIV Golf is in "live conversations" with "four different networks" for a media rights deal.

— James Colgan (@jamescolgan26) September 14, 2022

"The interest coming across our plate right now is enormous." pic.twitter.com/YFEwL0JciN

It has been long believed that LIV’s YouTube situation is driven primarily by tepid interest from the networks, who see the league’s controversial ties as a significant roadblock toward profitability. But in his interview with ESPN 1000, Norman argued the opposite was the case, saying that a host of bidders are currently in active negotiations for LIV’s rights.

“We’re talking to four different networks — and live conversations where offers are being put on the table,” Norman said. “Because [the networks] can see the value of our product, they can see what we’re delivering.”

Of course, it should be noted that it is in Norman’s best interest for the networks to enter a bidding war for LIV’s broadcast rights. In a typical negotiation, a network will bid for a sports property’s television or streaming rights based on the total amount of advertising revenue the network believes it can generate from the league. In a situation in which only one bidder emerges, a network is incentivized to provide a lowball offer, maximizing the potential profits from the league. In a situation in which multiple bidders emerge, however, the power shifts to the league, which can leverage the networks against each other to receive the most competitive offer.

Why media rights are at the heart of the LIV-PGA Tour antitrust lawsuitBy: James Colgan

It’s possible Norman’s comments amount to little more than spin, attempting to drum up leverage for the new league in an environment in which most of its potential partners are already spoken for. CBS and NBC — two sports TV behemoths — already own the TV rights to the PGA Tour, eliminating them from consideration, while dark-horse candidates like ESPN and Turner (owned by Warner-Discovery) have their own far-reaching connections to the Tour. That leaves FOX, which is owned by Norman’s old friend Rupert Murdoch and has no outstanding connection to the PGA Tour, but they jumped ship midway through a $1.1 billion agreement with the USGA in 2020 for a reason — golf was not particularly profitable. Many of the most likely candidates reside in the streaming world, where Amazon, Apple and Fubo are among the well-funded players to enter the world of sports TV over the last few months. But even then, the same concerns exist around entering a partnership with the new league.

Still, any kind of agreement would be a massive addition for LIV both in terms of its long-term financial prospects and public viability. Even if the Saudi Public Investment Fund’s financial backing is enough to keep the league functioning in the short-to-medium term, it would seem likely that LIV’s financiers would like to see some degree of financial and commercial viability from their multi-billion dollar investment. Without some sort of media deal, that viability is impossible.

The good news for LIV is that after Wednesday, a deal of some kind seems likely. That is, so long as Norman is telling the truth.