LIV Golf’s next big TV test starts now — and the result will reveal much

- Share on Facebook

- Share on Twitter

- Share by Email

After Bryson DeChambeau's season-ending win, LIV heads into the offseason with a new TV challenge.

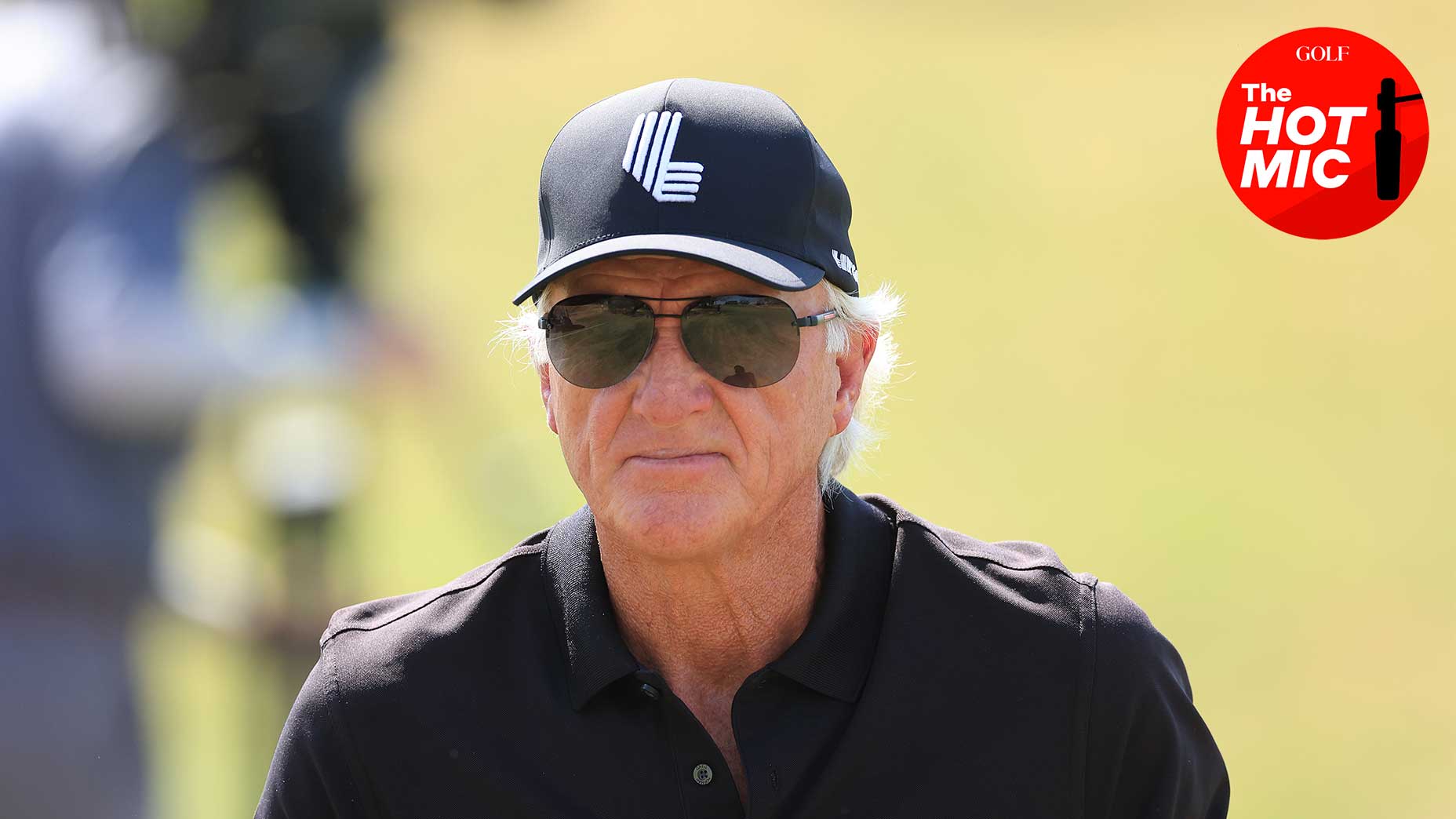

Getty Images

The season is officially over for LIV Golf, which means for Will Staeger, the real work is only beginning.

Staeger, LIV’s chief media officer, and his team have faced a host of challenges admirably in the league’s first two years, launching a golf broadcast with a distinct feel and pace practically from thin air (aided, in part, by limited commercial sponsors). But one area where the upstart league has failed to find its footing quite as gracefully is in the turbulent world of sports television rights, where LIV remains on the hunt for partners heading into year 3.

The league has just one domestic TV rights partner, the CW, a network with which the league has just completed the first season of a two-year agreement. But that deal only covers the league’s weekend broadcasts, not its Friday opening rounds, meaning that approximately 33 percent of LIV’s possible airtime is not being fully monetized.

Staeger knows that has to change, which is why, the Hot Mic has learned, he and his team are doubling down on their efforts this week at the Sportel sports media conference in Monaco. Every year, the conference serves as one of the throughlines of the sports-media world — a convention for sports media brands and sports properties from around the globe. Staeger and the media team at LIV are hopeful that their attendance at the event will help expedite preliminary conversations with some of the league’s targets, opening the doors for a new domestic TV and streaming partner(s) to sign on by the beginning of next year.

The big question still facing Staeger is whether LIV can manage to wrangle not only a partner but also a significant one. The major players — CBS, FOX, NBC, Disney, Warner Bros. Discovery — have largely stayed out of LIV’s business, but their considerable sports-rights war chest and audience sizes could play a crucial role in solidifying the league’s standing with golf audiences. Interest in golf TV rights remains high among this group, particularly after ESPN signed on to broadcast Tiger Woods and Rory McIlroy’s team golf league, the TGL, beginning in January.

LIV has been coy about its TV rights in the past, including a lengthy negotiation period for its weekend domestic rights last year that spawned dozens of rumors about potential partners. At one point, commissioner Greg Norman said the league had at least four potential partners in the bidding; at another, LIV was reported to be on the brink of signing a pay-for-time agreement with Fox Sports. Eventually, LIV signed with the CW, a non-traditional TV partner that was only beginning to enter the live sports game.

It’s hard to say if the market will find any more excitement for LIV’s rights this time around. On one hand, the league has managed to carve out a real subsection of the golf audience with a roster that includes many of the sport’s biggest names; also, with only one year remaining on LIV’s contract with the CW, an agreement could pave a path to exclusive rights within a year. On the other hand, a litany of concerns — ethical questions, stagnating growth and the looming state of a definitive agreement between the Saudi PIF and the PGA Tour, among others — may still weigh heavily on potential partners.

Interestingly, Staeger and other LIV officials have argued that the proposed merger with the PGA Tour has actually aided LIV’s efforts at finding sponsors and TV partners, though it should be noted that no considerable agreements have been announced on either front since the merger news first broke.

After two LIV seasons, here’s what the league has (and hasn’t) accomplishedBy: James Colgan

“What’s been interesting in the past few weeks is a reinvigorated sense of interest from the TV world,” Staeger told GOLF.com in August. “We’ve set up conversations with all major networks around the world.”

No matter who eventually signs LIV, it will be fascinating to see the structure of the agreement. LIV’s deal with the CW is atypical for sports TV in that the league did not immediately receive a rights fee from the CW. Instead, the two sides opted for a revenue split that has seen both the league and the network share the profits from advertising sold on the league’s broadcasts. It’s not clear if the league will continue to operate under this structure in 2024, or if it will graduate to a more traditional payer-and-payee arrangement, but all options would seem to be on the table with new partners as LIV heads to market.

In any case, it’s hard to understate the importance of this moment for LIV. A new TV agreement, whenever it arrives, will offer some clues as to how the league is viewed within the greater sports ecosystem, as well as how the league plans to start generating revenue on behalf of its Saudi financiers, who have poured billions into the league since its founding last year. For those hoping to gain some greater context about how things have changed for LIV over the last 12 months, the league’s new broadcast partners will provide just that.

LIV’s offseason may have just begun, but for some members of the league, this is no time for kicking back.

Turn your Hot Mic on the author at james.colgan@golf.com.

Latest In News

James Colgan

Golf.com Editor

James Colgan is a news and features editor at GOLF, writing stories for the website and magazine. He manages the Hot Mic, GOLF’s media vertical, and utilizes his on-camera experience across the brand’s platforms. Prior to joining GOLF, James graduated from Syracuse University, during which time he was a caddie scholarship recipient (and astute looper) on Long Island, where he is from. He can be reached at james.colgan@golf.com.