The PGA Tour currently enjoys tax-exempt status in the eyes of the federal government, saving them millions of dollars a year. But the free ride may come to end sooner rather than later.

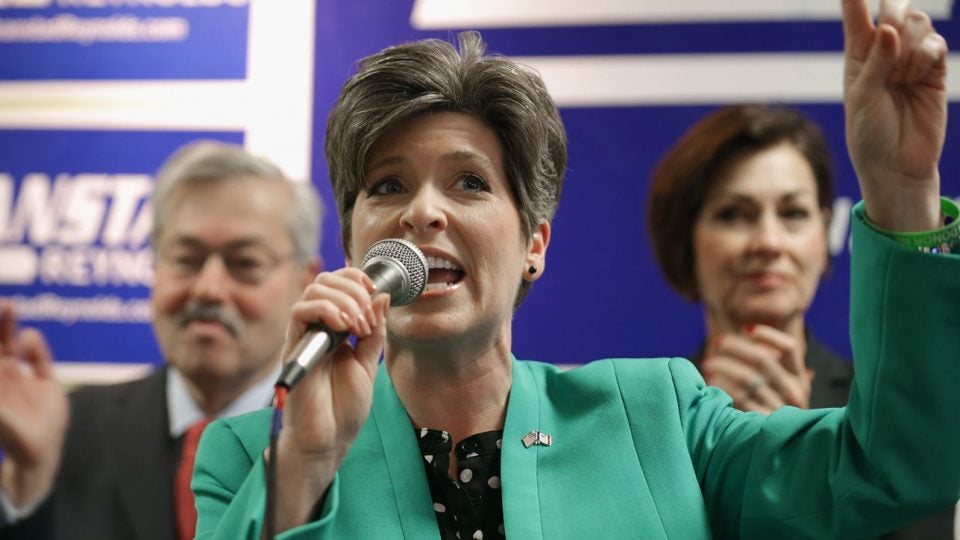

Last week, Senators Joni Ernst (R-IA) and Angus King (I-ME) announced new legislation, the Properly Reducing Overexemptions for Sports Act (or the PRO Sports Act). If passed, the bill would strip professional sports leagues like the PGA Tour of their tax-exempt status, resulting in $100 million in savings for the federal government over 10 years.

In a press release about the bill, Ernst used a golf term to underscore the importance of the legislation. “Professional sports leagues – which are raking in millions of dollars from television rights and membership dues – shouldn’t also be scoring a hole-in-one with their taxes. The PRO Sports Act amends the tax code to revoke this unnecessary exemption.”

King called out the Tour by name in his own statement about the bill, saying, “Sports leagues like the NHL and the PGA Tour provide entertainment for millions of Americans, but that doesn’t mean these league-specific brands should be able to utilize Section 501(c)(6) of the tax code to be tax exempt. This bill would help close loopholes that allow leagues to boost their profits at the expense of taxpayers.”

Different politicians have attempted to pass similar legislation several times in the past. Most recently, the bill was included in an early draft of the large Republican tax bill that Congress passed in late 2017. But when the Tour got wind of it, they quickly summoned a major lobbying effort to get it removed from the bill. Davis Love III even traveled to Washington on the Tour’s behalf to lobby members of Congress in person, according to Sports Business Daily, after which “the provision that would have impacted the Tour was removed.”