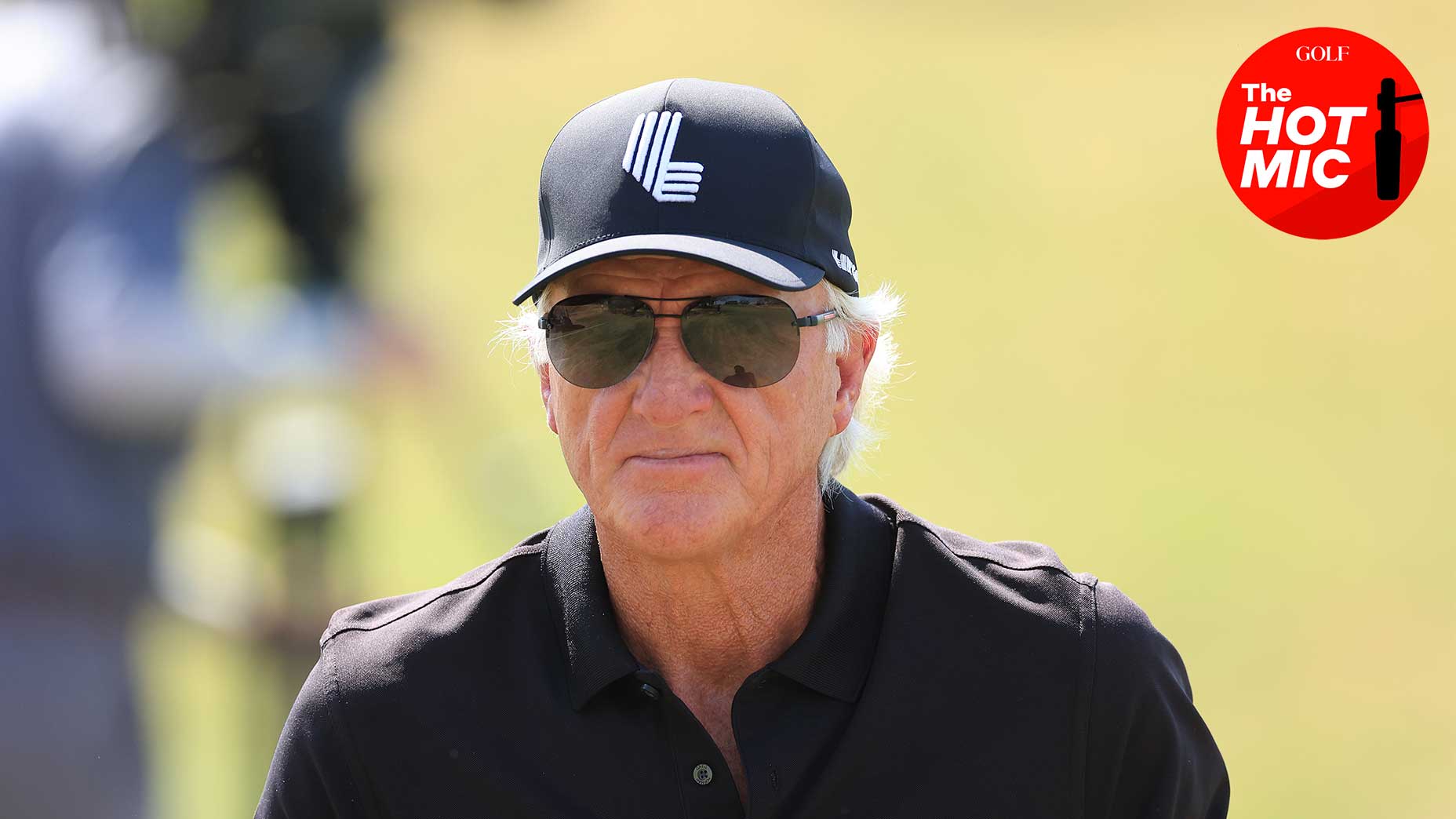

As head of LIV Golf, it is Greg Norman’s job to understand the league’s business.

And because Greg Norman understands LIV’s business, he knows a tremendous roadblock remains in the league’s way.

Television.

The problem is not so much that LIV is uninterested in golf television. Au contraire — the league has poured millions into production resources and hired an army of technicians and producers to work on the project of delivering a consistent, high-quality product. Rather, the issue is the other way around: golf television is uninterested in LIV. And in an interview with Sports Illustrated this week assessing the nascent league’s state of affairs, Norman was unusually candid in admitting LIV’s failures to deliver a high-quality TV contract.

“Where we’re falling short is due to the headwinds in not getting a network [TV] deal,” Norman said, ominously. “That creates uncertainty in the marketplace. [A lot of companies say] let’s see what happens. That rolls into sponsorship. We have an enormous number of big corporations who are talking to us and would be very keen to come on.”

Welcome back to the Hot Mic, GOLF’s vertical covering all things golf media. Today we’re talking about the latest words from Greg Norman on LIV’s TV rights — but if you’d like to receive news like this directly to your inbox before it reaches the web, we’d love it if you subscribed to the Hot Mic Newsletter here.

First, let’s recap how we reached this point: LIV has existed for three years. In those three years, two seasons aired on television in a near-zero-revenue deal on the CW Network, while one season streamed for free in an even-lesser-revenue deal on YouTube. LIV’s deal with the CW promises a revenue share, but LIV’s broadcasts have routinely failed to reach even modest golf TV audiences, meaning the league has failed to receive even modest sums from the CW.

Broadcast TV is the lifeblood of the sports business — the fountain from which all money-making sports entities drink. If those who seek to “break into” the sports business wish to survive — be they LIV, the TGL, or even the USFL — they must find a strategy for 1. landing on TV and 2. attracting sizeable and repeatable television audiences to watch them.

The reason for this is simple: Networks pay leagues, and advertisers pay networks. Without the money earned from ads, there is no business case for a network to pay a sports league for its broadcast rights. Stated even more simply: viewer interest is the most valuable commodity in sports television, and right now, LIV has none.

In some ways, though, the problem also works in reverse: without the help of a high-profile TV network, LIV might not be able to increase viewer interest. At least that’s what Norman seems to be alluding to in his latest comments to SI. The issue isn’t that LIV has no interested sponsors, Norman appears to be saying, it’s that LIV’s interested sponsors don’t want to help bankroll a product that nobody cares to watch. But if LIV were to change viewer interest — perhaps by wrangling a new TV contract with one of the sports world’s biggest networks — that might be enough to entice a host of new business partners to spend money with LIV.

And what is LIV trying to do in this pivotal offseason? Surprise, surprise — land a new TV contract after the league’s deal with the CW lapsed at the end of the ’24 season.

“Again, the question is: What is going to happen with the [new TV] deal?” Norman said. “Whether it happens or it doesn’t is going to set the marketplace at ease. When we know what we’ll do and the marketplace will know how to navigate the situation. But the headwinds continue from a scheduling and venue perspective as well.”

Of course, it’s hard to take Norman entirely at his word. This is the same league commissioner who boasted about having multiple “major” TV partners interested back in ’21, and who has repeatedly fanned the flames of speculation surrounding the league’s operations in ways that usually fail to reach fruition.

But it is not hard to believe how a new TV deal could improve LIV’s business picture. A deal with companies like FOX or Warner Bros. Discovery (two networks without preexisting PGA Tour contracts) could bring legitimacy and promotion to LIV’s broadcasts in a way that an extension of the league’s current deal with the CW can’t. That might encourage a flood of regular FOX or WBD advertisers to enter into more serious business with LIV, or encourage some of LIV’s current “interested parties” to become full-fledged sponsors.

It’s early to say any of that is certain to happen, but LIV’s odds appear better in ’24 than they did in ’21. The league has retained the high-powered talent firm CAA, a long-time partner of the PGA Tour, to represent it in negotiations for a TV partnership — and has reunification talks with the PGA Tour to dangle before network partners as a sign of its staying power.

A lot rides on LIV’s negotiation skills over the coming months and years, and commissioner Norman knows this. His contract expires at the end of next season, and a TV deal would go a long way towards solidifying his legacy as the league’s first leader.

In other words, now is the time for Norman to be optimistic, and rest assured, he is.

“I’m just talking about LIV; we’ve been true to ourselves and our business model,” Norman said. “I’ve tried to take the high road. We knew what we had and what we are doing is right. Time and patience is our greatest ally … 36 tournaments (in three years) is nothing. The PGA Tour has been around for 56. And we’ve done it in three years. That’s why I’m an optimist looking into the future and where we will be in 10 years.”